Uncategorized Friday, 2025/06/06

The current oncology drug market is at a critical period of product iteration and technological innovation. Traditional drugs, whose patents are expiring, are rapidly exiting the historical stage, while new therapeutic paradigms, fueled by emerging technologies like ADCs, are continuously reshaping the competitive landscape of the market.

The oncology treatment sector has always been a focal market fiercely contested by major pharmaceutical giants. In 2024, its global market size has reached a new historical high, with the top 30 best-selling oncology drugs achieving a total sales of $147.4 billion, an increase of $15.1 billion compared to the previous year.

2024 Global Top 30 Oncology Drug Sales (in Billion USD)

|

No. |

Drug |

Company |

Target |

Main Indications |

Sales in 2024 (100 million RMB) |

Growth Rate |

|---|---|---|---|---|---|---|

|

1 |

Keytruda (pembrolizumab) |

Merck & Co. |

Melanoma, non-small cell lung cancer, head and neck cancer, etc. |

294.82 |

17.9% |

|

|

2 |

Darzalex (daratumumab) |

Janssen |

Multiple myeloma |

116.70 |

19.8% |

|

|

3 |

Opdivo (nivolumab) |

Bristol-Myers Squibb/Ono |

Melanoma, non-small cell lung cancer, renal cell carcinoma, etc. |

101.44 |

8.1% |

|

|

4 |

Tagrisso (osimertinib) |

AstraZeneca |

T790M mutation non-small cell lung cancer |

65.80 |

13.0% |

|

|

5 |

Imbruvica (ibrutinib) |

AbbVie/Janssen |

CLL/SLL, MCL, GVHD |

63.85 |

-6.9% |

|

|

6 |

Xtandi (enzalutamide) |

Astellas Pharma/Medivation |

Prostate cancer |

59.26 |

16.9% |

|

|

7 |

Revlimid (lenalidomide) |

Bristol-Myers Squibb |

CRBN/CK1a, etc. |

MM, bone marrow dysplasia syndrome, MCL, FL |

57.73 |

-5.3% |

|

8 |

Verzenio (abemaciclib) |

Eli Lilly |

Breast cancer |

53.07 |

37.4% |

|

|

9 |

Jakafi (ruxolitinib) |

Incyte/Novartis |

Myelofibrosis, polycythemia vera, etc. |

47.28 |

9.6% |

|

|

10 |

Imfinzi (durvalumab) |

AstraZeneca |

Urinary tract carcinoma, NSCLC, SCLC, etc. |

47.17 |

17.0% |

|

|

11 |

Ibrance (palbociclib) |

Pfizer |

Breast cancer |

43.67 |

-8.1% |

|

|

12 |

Tecentriq (atezolizumab) |

Roche |

Urinary tract carcinoma, NSCLC, triple-negative breast cancer |

41.45 |

0% |

|

|

13 |

Perjeta (pertuzumab) |

Roche |

HER2+ breast cancer |

41.18 |

1% |

|

|

14 |

Enhertu (trastuzumab deruxtecan) |

Daiichi Sankyo/AstraZeneca |

Breast cancer, stomach cancer, etc. |

37.54 |

46.0% |

|

|

15 |

Lynparza (olaparib) |

AstraZeneca/Merck & Co. |

Ovarian cancer, breast cancer, etc. |

36.72 |

20.0% |

|

|

16 |

Pomalyst/Imnovid (pomalidomide) |

Bristol-Myers Squibb |

Multiple myeloma |

35.45 |

3.0% |

|

|

17 |

Calquence (acalabrutinib) |

AstraZeneca |

Mantle cell lymphoma, CLL/SLL, DLBCL |

31.29 |

24.0% |

|

|

18 |

Kisqali (ribociclib) |

Novartis |

Breast cancer |

30.33 |

45.8% |

|

|

19 |

Erleada (apalutamide) |

Janssen |

Prostate cancer |

29.99 |

25.6% |

|

|

20 |

Brukinsa (zanubrutinib) |

BeiGene |

Blood cancer |

26.00 |

101.6% |

|

|

21 |

Venclexta (venetoclax) |

AbbVie |

CLL, acute lymphoblastic leukemia |

25.83 |

12.9% |

|

|

22 |

Yervoy (ipilimumab) |

Bristol-Myers Squibb |

Melanoma, renal cell carcinoma, colorectal cancer |

25.30 |

13.0% |

|

|

23 |

Kadcyla (trastuzumab emtansine) |

Roche |

HER2+ breast cancer |

22.75 |

7.0% |

|

|

24 |

Xgeva (denosumab) |

Amgen |

Bone metastasis of solid tumors, multiple myeloma |

22.25 |

5.4% |

|

|

25 |

Lenvima (lenvatinib) |

Eisai/Merck & Co. |

VEGFR, etc. |

Hepatocellular carcinoma, endometrial cancer, renal cell carcinoma, etc. |

21.40 |

6.4% |

|

26 |

Tafinlar+Mekinist (dabrafenib+trametinib) |

Novartis |

Melanoma, NSCLC |

20.58 |

7.1% |

|

|

27 |

Phesgo (trastuzumab+pertuzumab) |

Roche |

HER2+ breast cancer |

19.82 |

62.0% |

|

|

28 |

Adcetris (brentuximab vedotin) |

Seattle Genetics/Takeda |

Hodgkin lymphoma, peripheral T-cell lymphoma |

19.17 |

/ |

|

|

29 |

Erbitux (cetuximab) |

Eli Lilly/Merck KGaA |

Colorectal cancer, head and neck squamous cell carcinoma |

18.87 |

10.5% |

|

|

30 |

Reblozyl (luspatercept) |

Bristol-Myers Squibb |

Myelodysplastic syndromes, etc. |

17.73 |

69.9% |

Note: Converted at the average exchange rate of 2024: 1 Danish Krone = $0.14514, 1 Euro = $1.0847, 1 Swiss Franc = $1.1388, 1 British Pound = $1.2813, 100 Japanese Yen = $0.66323.

From the perspective of drug types, the list includes 16 small molecule drugs, 10 monoclonal antibody drugs, 3 ADC drugs, and 1 fusion protein. Despite small molecule drugs holding a numerical advantage, monoclonal antibody drugs surpass them in total sales ($64.825 billion vs. $72.9 billion).

Within the TOP30 list, the top three drugs are all monoclonal antibody drugs: Merck's Keytruda (pembrolizumab), Johnson & Johnson's Darzalex (daratumumab), and Bristol-Myers Squibb's Opdivo (nivolumab), each surpassing the $10 billion sales mark. Notably, besides Darzalex, the top five monoclonal antibodies are all PD-(L)1 inhibitors.

PD-1 Related Proteins

| Cat.No. # | Product Name | Source (Host) | Species | Tag | Protein Length | Price |

|---|---|---|---|---|---|---|

| Pdcd1-2303M | Recombinant Mouse Pdcd1, Fc-His tagged | Human Cells | Mouse | Fc&His | 1-167 a.a. | |

| CD274-593H | Recombinant Human CD274 Protein | HEK293 | Human | Non | 1-238 aa | |

| PDCD1-257H | Recombinant Human PDCD1, His-tagged, Biotinylated | HEK293 | Human | His | 21-167 a.a. | |

| PDCD1-3244H | Recombinant Human PDCD1, Fc-His tagged | Human Cells | Human | Fc&His | 1-167 a.a. | |

| PDCD1-1589H | Recombinant Human PDCD1, GST-tagged | E.coli | Human | GST | 1-288aa | |

| CD274-3309H | Recombinant Human CD274 protein, His-tagged | E.coli | Human | His | 181-290 aa | |

| PDCD1-188HAF488 | Recombinant Human PDCD1 Protein, Fc-tagged, Alexa Fluor 488 conjugated | CHO | Human | Fc | 25-167 a.a. | |

| PDCD1-822HAF488 | Recombinant Human PDCD1 Protein, His-tagged, Alexa Fluor 488 conjugated | HEK293 | Human | His | 154 | |

| PDCD1-191HAF647 |

Active Recombinant Human PDCD1 Protein, Fc-tagged, Alexa Fluor 647 conjugated

|

CHO | Human | Fc | 379 |

In the small molecule drug domain, AstraZeneca's Tagrisso (osimertinib), Astellas/Pfizer's Xtandi (enzalutamide), and Eli Lilly's Verzenio (abemaciclib) form the leading group, with sales reaching $6.58 billion, $5.926 billion, and $5.307 billion respectively. Imbruvica (ibrutinib) and Revlimid (lenalidomide) are experiencing a continuous decline in sales due to the patent cliff.

Three ADC drugs have also made it to the TOP30 list: AstraZeneca/Daiichi Sankyo's Enhertu (trastuzumab deruxtecan), Roche's Kadcyla (trastuzumab emtansine), and Pfizer/Takeda's Adcetris (brentuximab vedotin), with a combined revenue of $7.946 billion, showcasing the tremendous commercialization potential of ADC therapies. Enhertu, in particular, demonstrates strong growth with a 46% increase in sales, reaching $3.754 billion. Its indications now fully cover HER2-positive, HER2-low expression, and HER2-ultra-low expression breast cancer.

HER2 Proteins

| Cat.No. # | Product Name | Source (Host) | Species | Tag | Protein Length | Price |

|---|---|---|---|---|---|---|

| Erbb2-2514MA | Recombinant Mouse Erbb2 protein, Fc-tagged, APC labeled | HEK293 | Mouse | Fc | ||

| ERBB2-01 | Recombinant HER2/neu (478-584) | E.coli | Non | |||

| ERBB2-033H |

Active Recombinant Human ERBB2 Protein, Fc-tagged

|

HEK293 | Human | Fc | ||

| ERBB2-41H | Recombinant Human ERBB2 protein, hFc-tagged | HEK293 | Human | Fc | Thr23-Thr652 | |

| ERBB2-40HAF488 | Recombinant Human ERBB2 Protein, hFc-tagged, Alexa Fluor 488 conjugated | HEK293 | Human | Fc | 428 |

Additionally, the list includes a fusion protein drug, BMS’s Reblozyl (luspatercept), the world's first erythroid maturation agent, achieving an annual sales of $1.773 billion with a 70% growth rate. This success is primarily driven by the demand from anemia patients caused by first-line myelodysplastic syndrome (MDS).

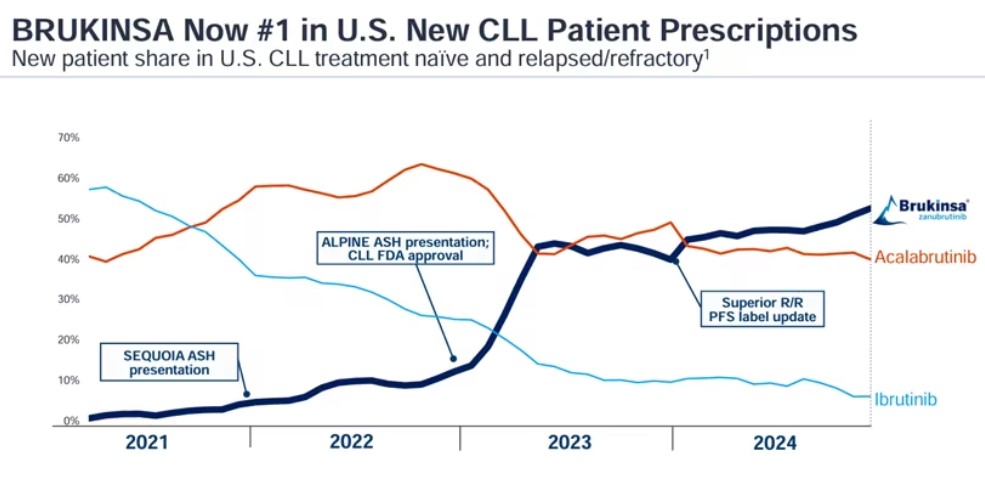

Apart from Reblozyl, the fastest-growing product is BeiGene's Brukinsa (zanubrutinib). Following its outstanding performance in head-to-head phase III trials against ibrutinib, it has successfully advanced to become a best-in-class molecule, rapidly establishing a strong market position. Currently, Brukinsa is the most widely approved BTK inhibitor globally, expanding robustly to compete against Calquence (acalabrutinib) and becoming the number one BTK inhibitor in the U.S. in terms of prescriptions.

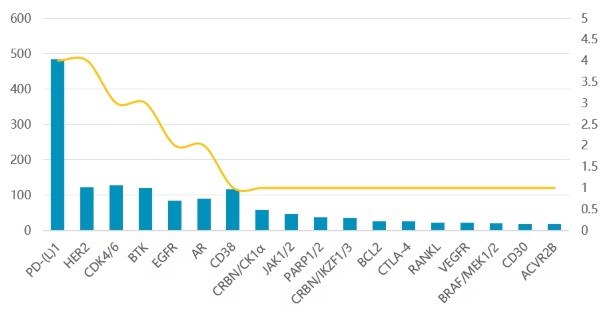

From a target competition perspective, PD-(L)1 continues to maintain absolute dominance, with this type of cancer immunotherapy having an extremely broad range of applications. For instance, Keytruda has been approved for 49 indications in the U.S., making it an indispensable therapeutic tool in the treatment of various cancers.

Targeted therapies in development

X-axis: Number of therapies, Y-axis: Investments (in billion USD)

Legend: Blue bar - Investments; Yellow line - Number of therapies

In target areas with large patient populations and relatively vertical markets, deep cultivation can also yield excellent results. Mature targets such as HER2 (breast/stomach cancer), CDK4/6 (breast cancer), BTK (hematologic tumors), EGFR (non-small cell lung cancer), AR (prostate cancer), and CD38 (multiple myeloma) continue to produce blockbuster drugs, and competition in these tracks is relatively intense.

Related Proteins

| Cat.No. # | Product Name | Source (Host) | Species | Tag | Protein Length | Price |

|---|---|---|---|---|---|---|

| CDK4-758H | Recombinant Human CDK4 protein, GST-tagged | Insect Cells | Human | GST | Met1-Glu303 | |

| CDK6-4947HF | Active Recombinant Full Length Human CDK6 Protein, GST-tagged | Sf21 Cells | Human | GST | Full L. 1-326(end) |

|

| AR-17H |

Recombinant Human AR, His-tagged

|

E.coli | Human | His | 2-556 a.a. | |

| CD38-653H |

Recombinant Human CD38 protein, His-tagged

|

HEK293 | Human | His | Val43-Ile300 | |

| CD38-574HP | Recombinant Human CD38 protein, Fc-tagged, R-PE labeled | HEK293 | Human | Fc |

From a company level, AstraZeneca's oncology business is experiencing rapid growth, with its core products providing strong support. BMS is progressing in both solid tumors and hematologic malignancies, building a vast product matrix.

Roche is accelerating the development of next-generation products based on its HER2 and PD-L1 foundations. With Keytruda, Merck maintains steady growth while actively exploring fields like ADCs. Johnson & Johnson, with its rich "monoclonal + bispecific + CAR-T" product portfolio in multiple myeloma, establishes its leading position.

Overall, the current oncology drug market is at a critical period of product iteration and technological innovation. Traditional drugs, whose patents are expiring, are rapidly exiting the historical stage, while new therapeutic paradigms, fueled by emerging technologies like ADCs, are continuously reshaping the competitive landscape of the market. As leading companies continue to shift their strategic focus towards the next generation of oncology drugs, the future of this therapeutic field might witness more disruptive industrial changes.